Hotel Volatility Index 2025

The Hotel Volatility Index (HVI), now in its eight year, is released as part of Hotelivate’s 2025 Indian Hospitality Trends and Opportunities.

We have often noticed that the performance statistics of a market can often be skewed by the opening of new hotels, which may not have fully stabilised and can lower occupancy, average rate, or both. This is particularly true for rapidly evolving hotel markets like India. To better understand the performance of established assets, we selected a base of 100 hotels that have been operational since 2012 or earlier, serving as a reliable index for equitable year-over-year benchmarking across India. The Hotel Volatility Index (HVI) can provide an accurate measure of the country’s hotel industry.

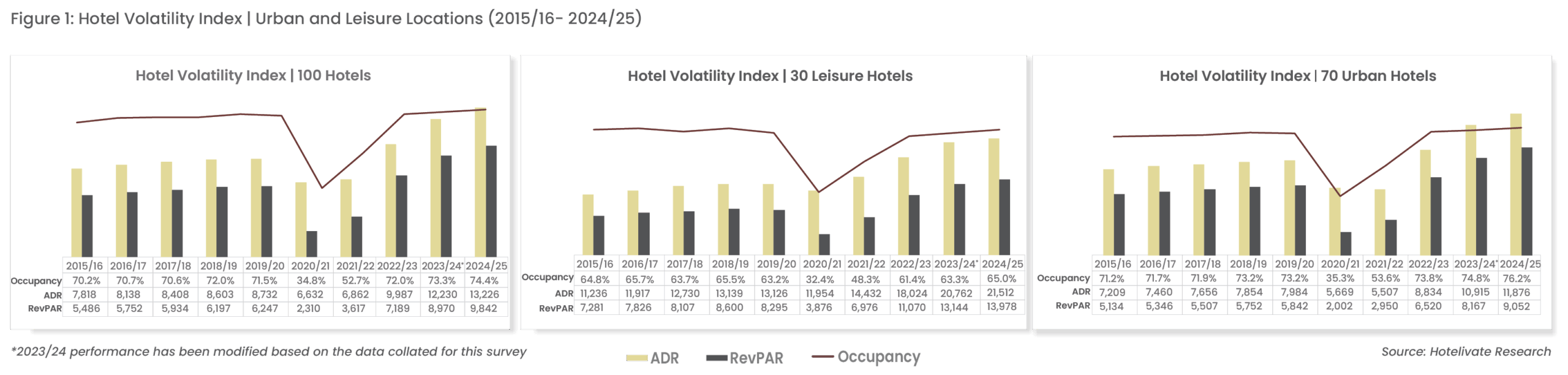

Figure 1 below illustrates the occupancy, average rate, and RevPAR performance of the 100 hotels between 2015/16 and 2024/25, further categorised by the type of location.

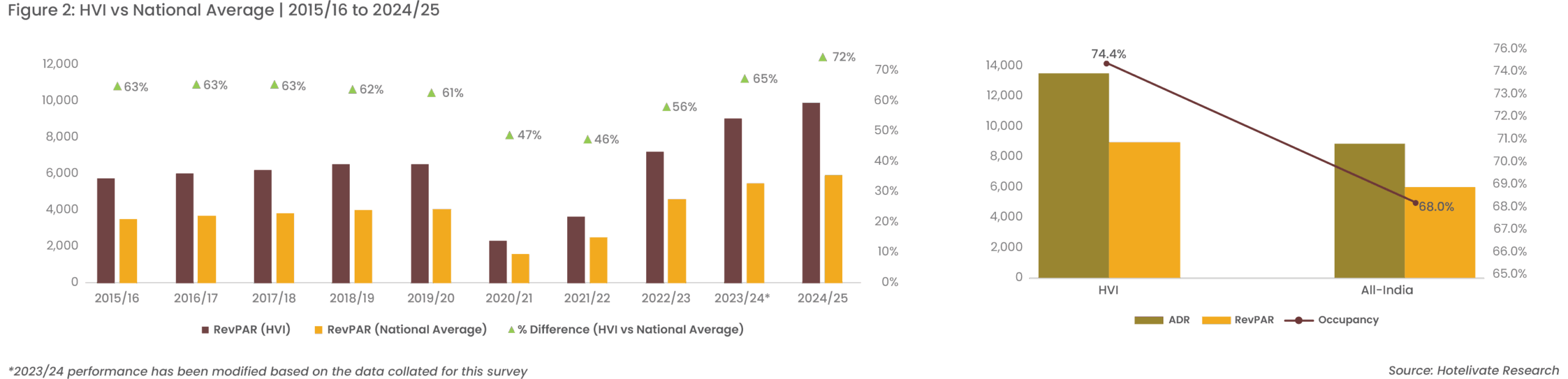

HVI hotels significantly outperformed the nationwide average in 2024/25, recording an occupancy premium of 9.4% and an ADR premium of 56.9%, which translated into a RevPAR premium of 71.2%, the highest recorded by established hotels in recent years. This strong performance is largely driven by the market positioning of HVI hotels, which are concentrated in mature, high-performing locations. In contrast, the broader hotel supply in 2024/25 includes a growing proportion of properties in developing or underpenetrated markets, creating a natural disparity in overall RevPAR performance. A closer look reveals that HVI hotels achieved an occupancy of 74.4%, compared to the nationwide average of 68.0%, and an ADR of ₹13,226 versus ₹8,432 for the overall market. This sharp contrast underscores a the premium pricing power and demand stability enjoyed by these high-value assets.

Furthermore, a comparison between urban and leisure hotel performance reveals notable shifts. While urban hotels recorded a 11.2% higher occupancy rate than leisure hotels, the latter continued to maintain a RevPAR premium of 54.4%. However, this gap is narrowing from the 60% delta seen in 2023/24. The improvement is largely attributed to a 10.8% year-on-year increase in RevPAR for urban hotels, while leisure hotels posted a more moderate growth of 6.3%. These trends suggest a recovery in demand for business and city-centric travel, narrowing the historical performance gap between leisure and urban markets, and highlighting the broader resurgence of urban hotel performance.

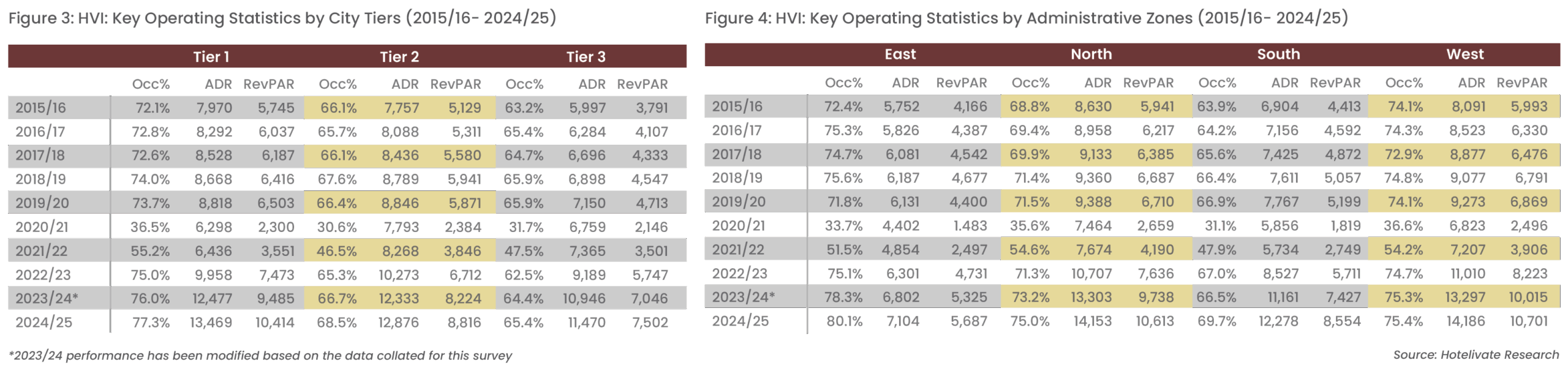

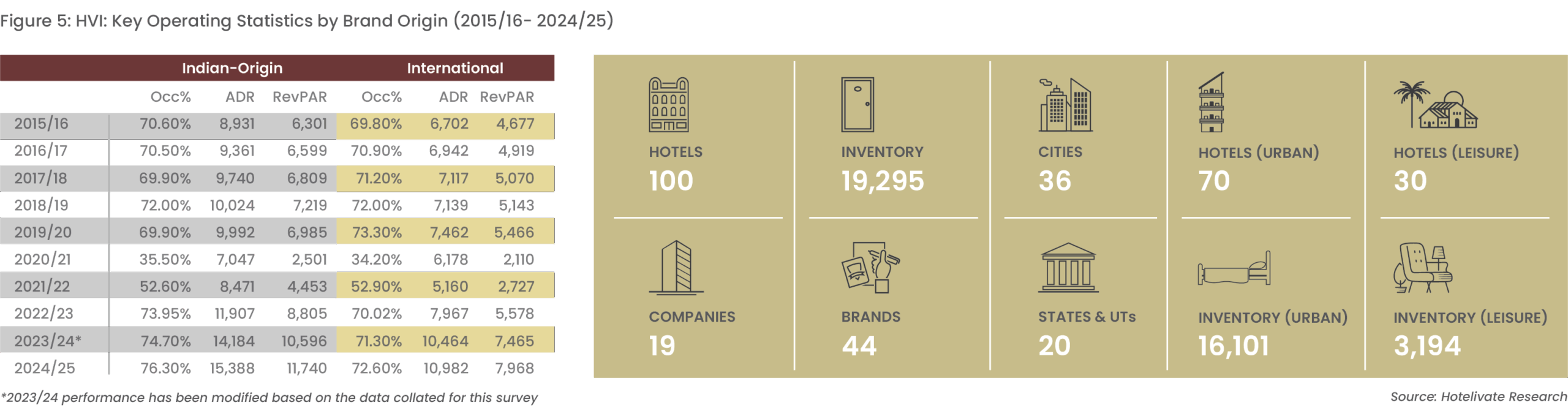

The figures below showcase the performance of HVI hotels compared to the national average as well as variations by city tiers, administrative zone, and brand origin.

In summary, we believe the Hotel Valuation Index (HVI) offers a reliable evaluation of the hotel industry’s performance over time. Stable-state assets not only exhibit resilience but also stand to gain significantly during industry recoveries. By capitalising on the efficiencies gained during turbulent times and adapting to evolving consumer behaviour, these hotels have achieved record-breaking results. This underscores the importance for hotel owners to practice patience, allowing their assets to stabilise and leverage economic resilience for consistent, higher returns. Moreover, it is essential for owners to invest in renovations and refurbishments to ensure their properties are well-maintained and continue to deliver superior returns. Hotels within the HVI sample set are likely to experience moderate rate growth while maintaining stable occupancy levels. Effective asset management, strategic sales and marketing, and talent development remain critical areas of focus to sustain performance and maximise returns during this period.

For more information, please contact Manav Thadani at [email protected]