Does Size Really Matter?

During brand selection, concept planning and design development, room size is consistently a point of debate between owners and brands. Brands generally advocate minimum specifications aligned with brand standards and owners often push up the specifications driven by personal preference. This frequently results in assets that are disconnected from market reality. With average hotel development costs of approximately ₹7,200 per sq. ft. (₹80,000 per sq. mt.), over-building has a material impact on overall development cost.

To evaluate whether larger guestroom sizes translate into stronger operating performance, the correlation between base room size and RevPAR achieved by branded hotels in 2024/25 was analysed. Base rooms constitute a significant share of a hotel’s inventory, and guestrooms typically account for 50%–80% of the total built-up area. The data was reviewed across multiple parameters, including location type (urban or leisure), administrative zones (north, south, east and west), brand origin (Indian or international), hotel size (by key inventory), city tier (Tier 1, Tier 2 and Tier 3), and positioning (budget through luxury). Taken together, the findings converge on a consistent conclusion: room size exhibits a limited correlation with RevPAR, and, therefore, over-specifying the product does not guarantee stronger returns.

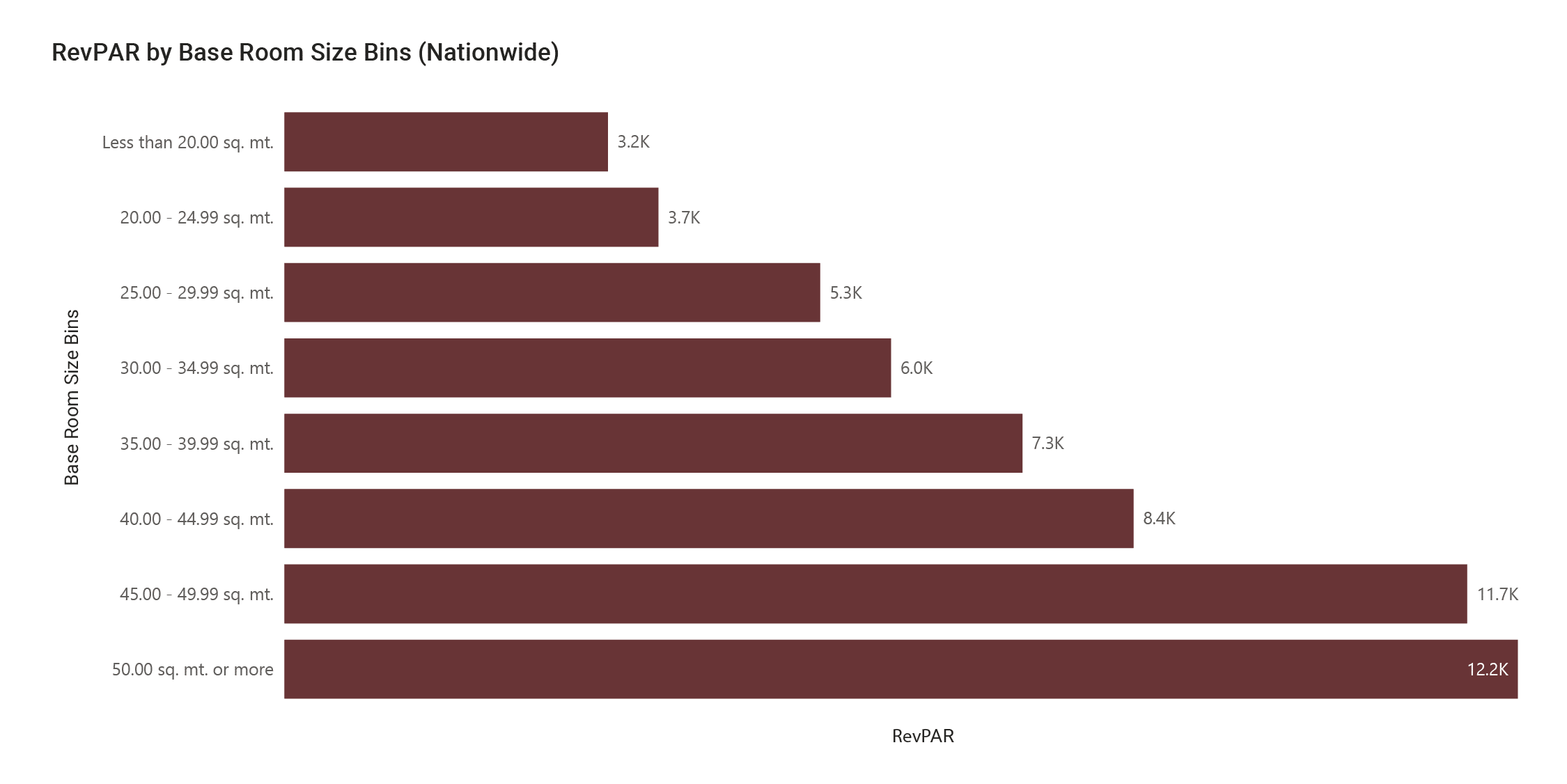

1. Nationwide RevPAR by Room Size: At an all-India level, a broad positive and direct relationship exists between room size and RevPAR; however, aggregated data masks underlying variations. When the dataset is analysed further, the correlation weakens considerably.

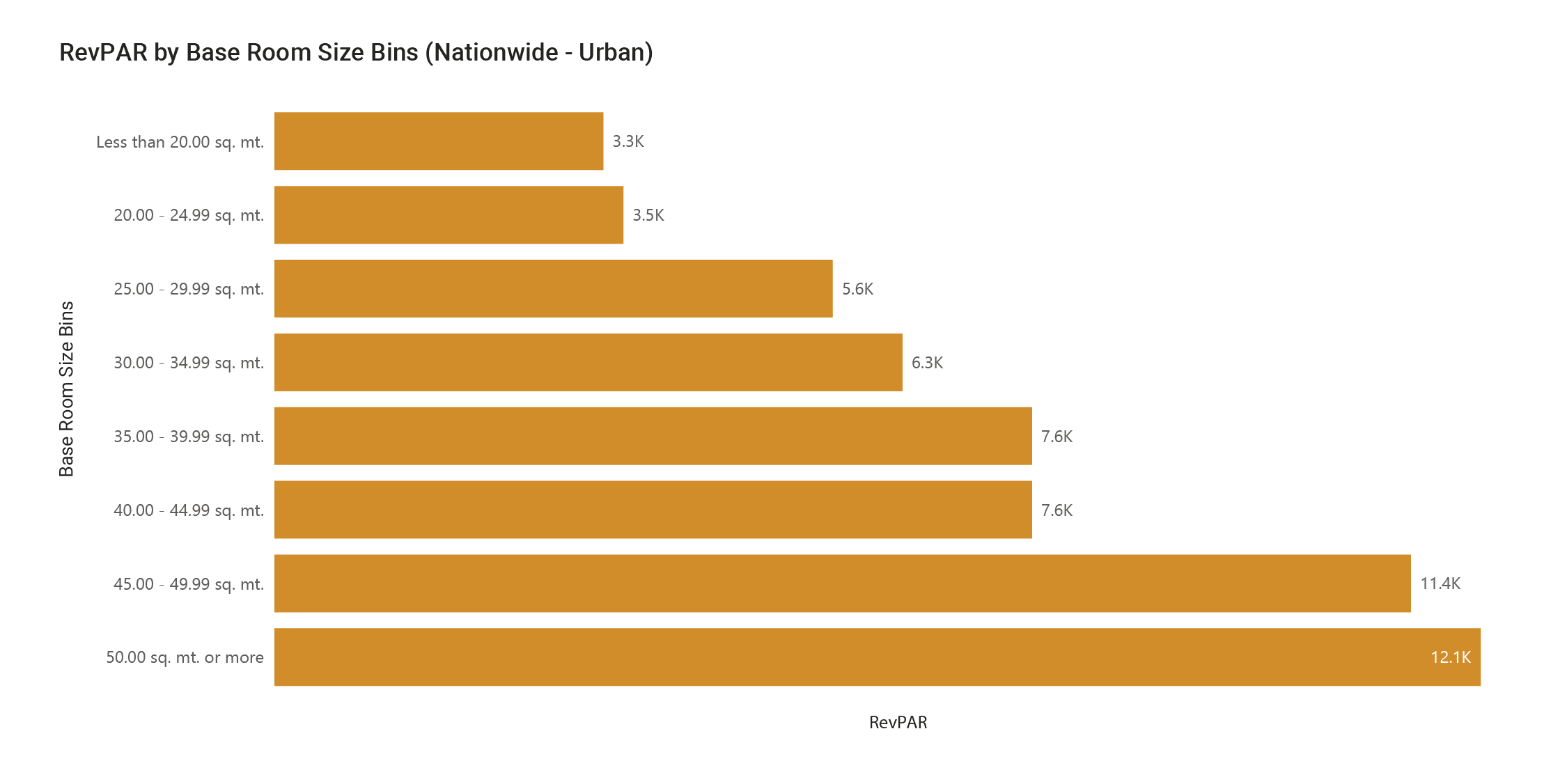

2. Nationwide Urban Hotels RevPAR by Room Size: A review of only urban hotels in India (representing 55% of the sample set by number of hotels) reveals an interesting trendline: properties with a base room size between 35 m² and 45 m² have a relatively similar RevPAR. It is worth noting that there is close to a 30% difference between the two ends of the size spectrum, yet the RevPAR achieved remains broadly similar.

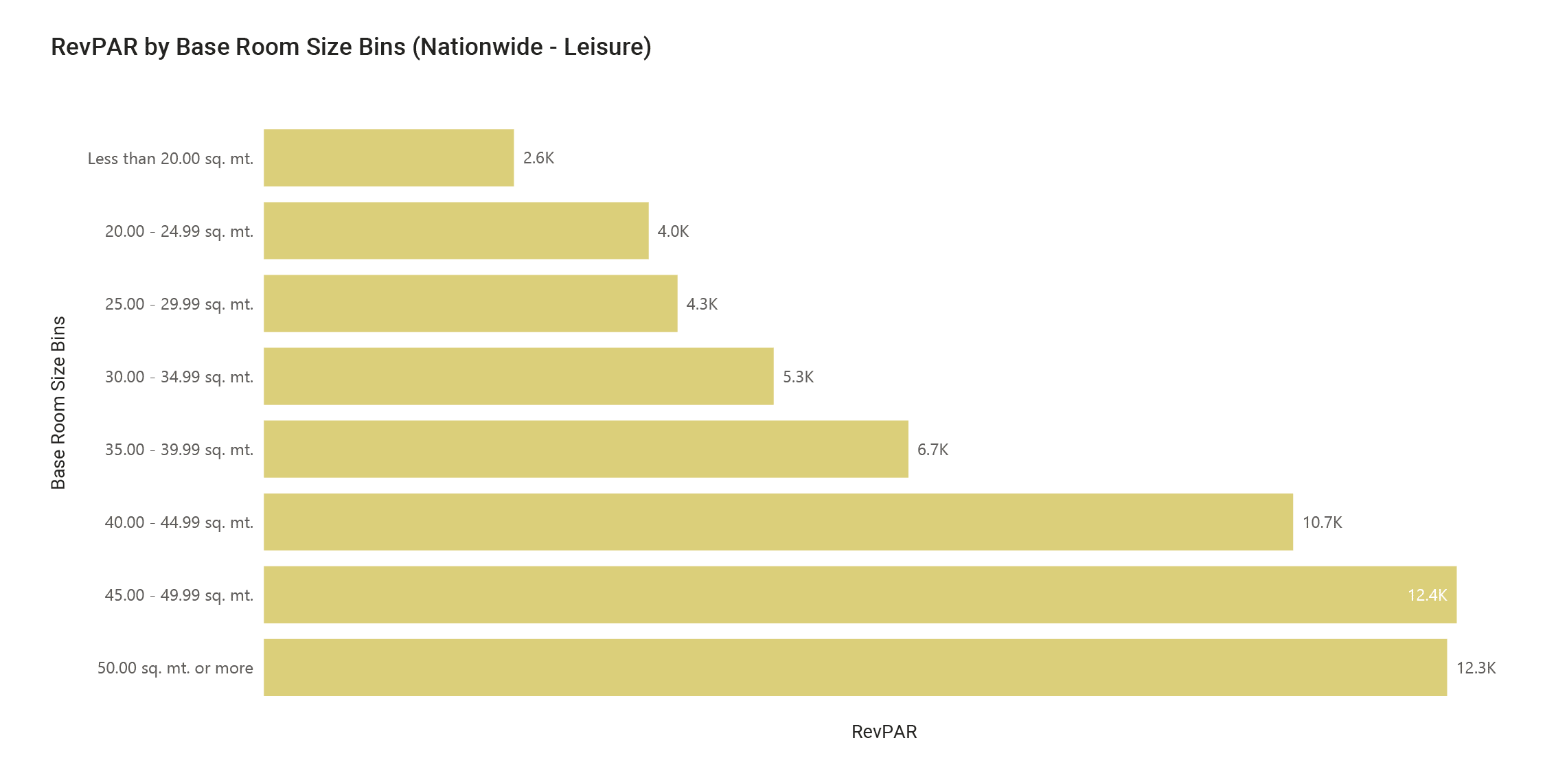

3. Nationwide Leisure Hotels by Room Size: In the case of leisure hotels in India (representing 45% of the sample set by number of hotels), properties with base room sizes between 45 m² and 50 m² record higher RevPAR compared to hotels with base room sizes exceeding 50 m². Although there is a minimum of an 11% increase in room size between 45 m² and 50 m², the relatively smaller rooms are delivering stronger RevPAR.

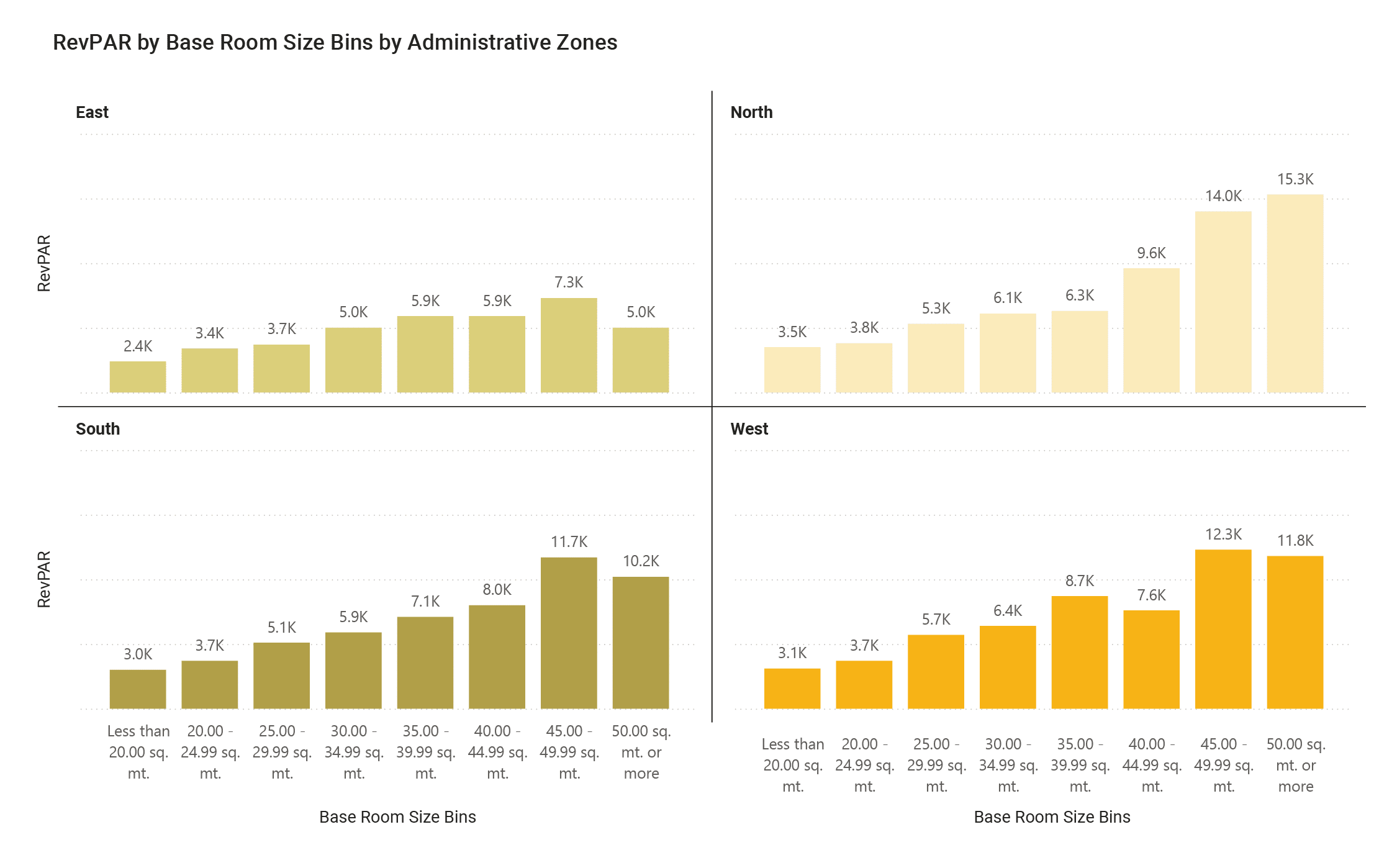

4. RevPAR by Administrative Zones and Room Sizes: Breaking down this data by administrative zones reveals that:

a) In the East, South and West Zones (~60% of the sample set by number of hotels), the 45 m² to 50 m² range performs better than the 50 m²+ base room size. This is a clear case where building larger rooms is not yielding the requisite performance delta.

b) In the East and West (~37% of the sample set by number of hotels), the 35 m² to 40 m² range either performs better or remains at par with the 40 m² to 45 m² range. There is close to a 30% difference in room size between 35 m² and 45 m², yet performance remains comparable, and, in certain instances, the relatively smaller base room size outperforms.

c) In the North (~40% of the sample set by number of hotels), the 30 m² to 40 m² range demonstrates relatively similar performance. Once again, a 33% difference between the two ends of the size spectrum does not yield any material gain in terms of RevPAR.

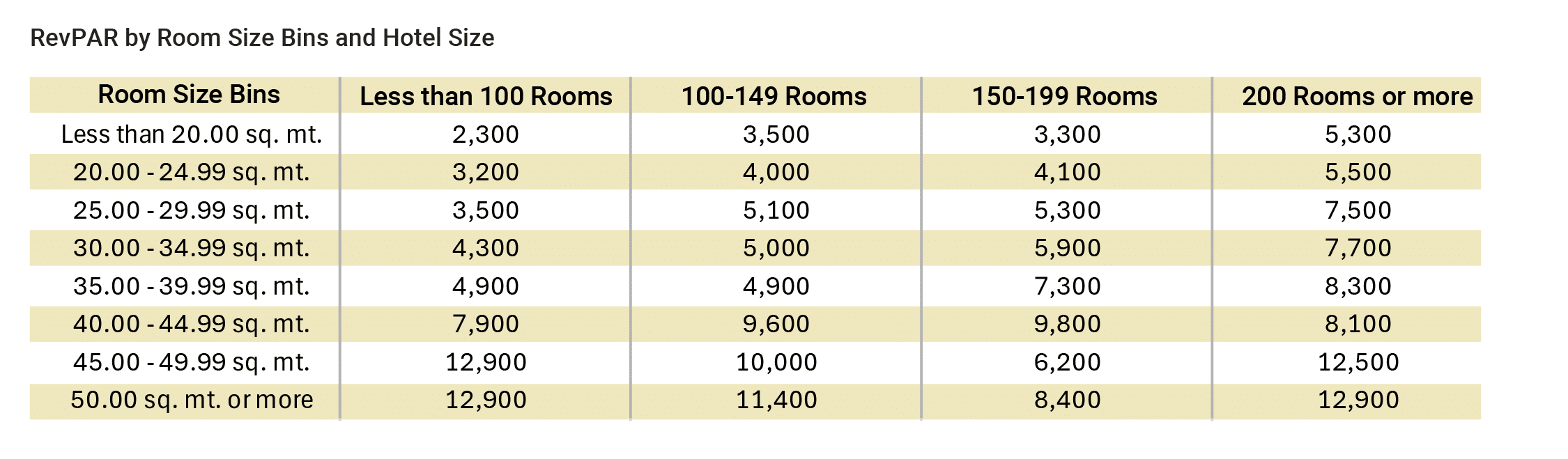

5. RevPAR by Hotel Size and Room Size: Looking at the same data from the lens of hotel sizes reveals the following:

a) For hotels with an inventory of 100 to 149 keys (~17% of the sample set by number of hotels), there is no discernible difference between the RevPAR achieved by rooms sized between 25 m² and 40 m². There is close to a 60% increase in base room size between the two ends of the spectrum, yet this corresponds with a decline in RevPAR and, consequently, overall performance.

b) On the other hand, for hotels with an inventory of 150–199 rooms and 200 rooms or more (together representing 18% of the sample set by number of hotels), the RevPAR remains stable across the 25 m² to 35 m² range. In this case, there is a 40% increase in base room size between the two ends of the spectrum, yet no associated performance gains.

“Notably, approximately 65% of hotels in India have an inventory of fewer than 100 keys, whereas only about 11% have an inventory of 200 rooms or more.”

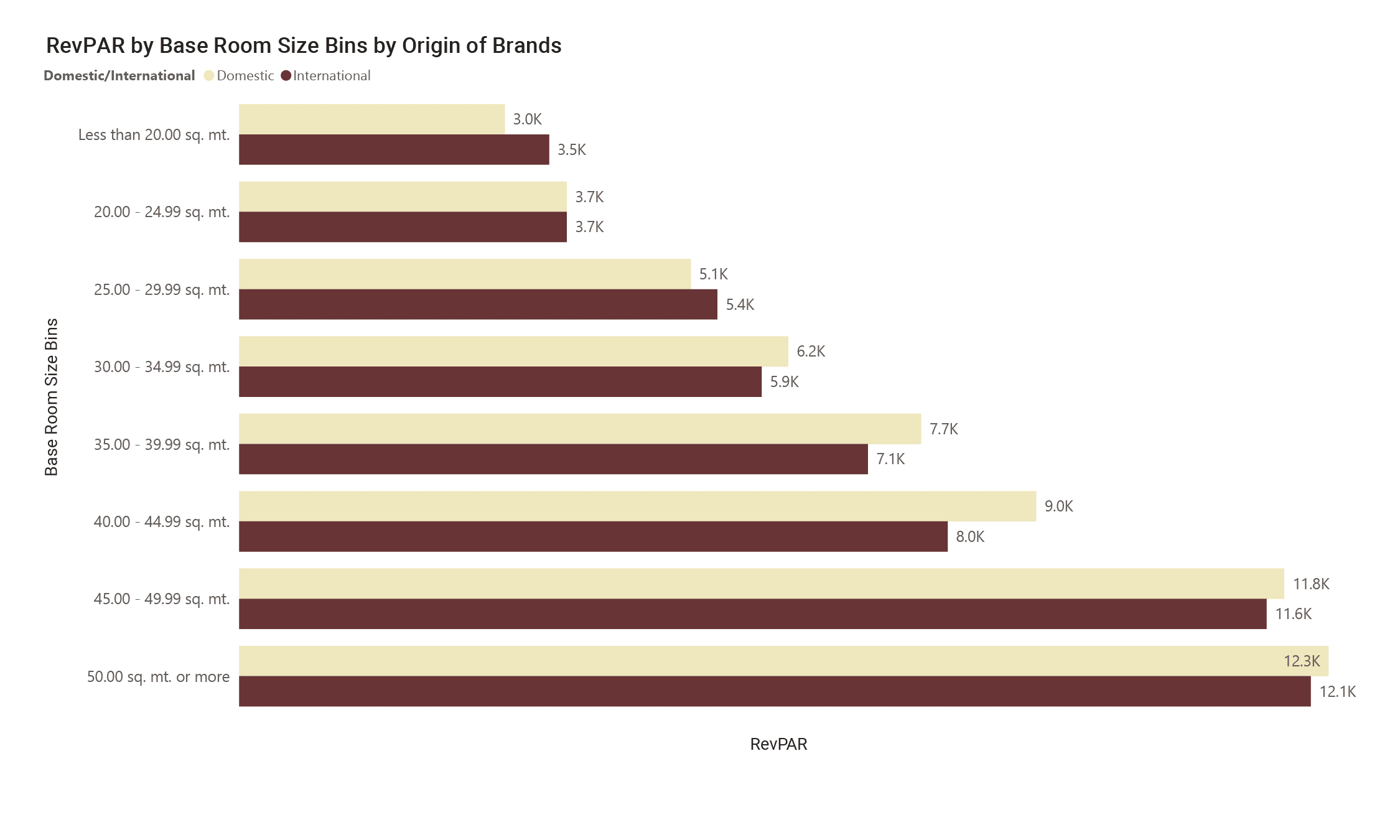

6. RevPAR by Origin of Brand and Room Size: Notably, when examining RevPAR through the lens of brand origin, both Indian-origin brands and international brands record similar performance levels across the various room sizes, with only minor variations. This indicates a consistent philosophy and similarity in approach for development across both groups, which appears to contribute to the normalisation of the averages.

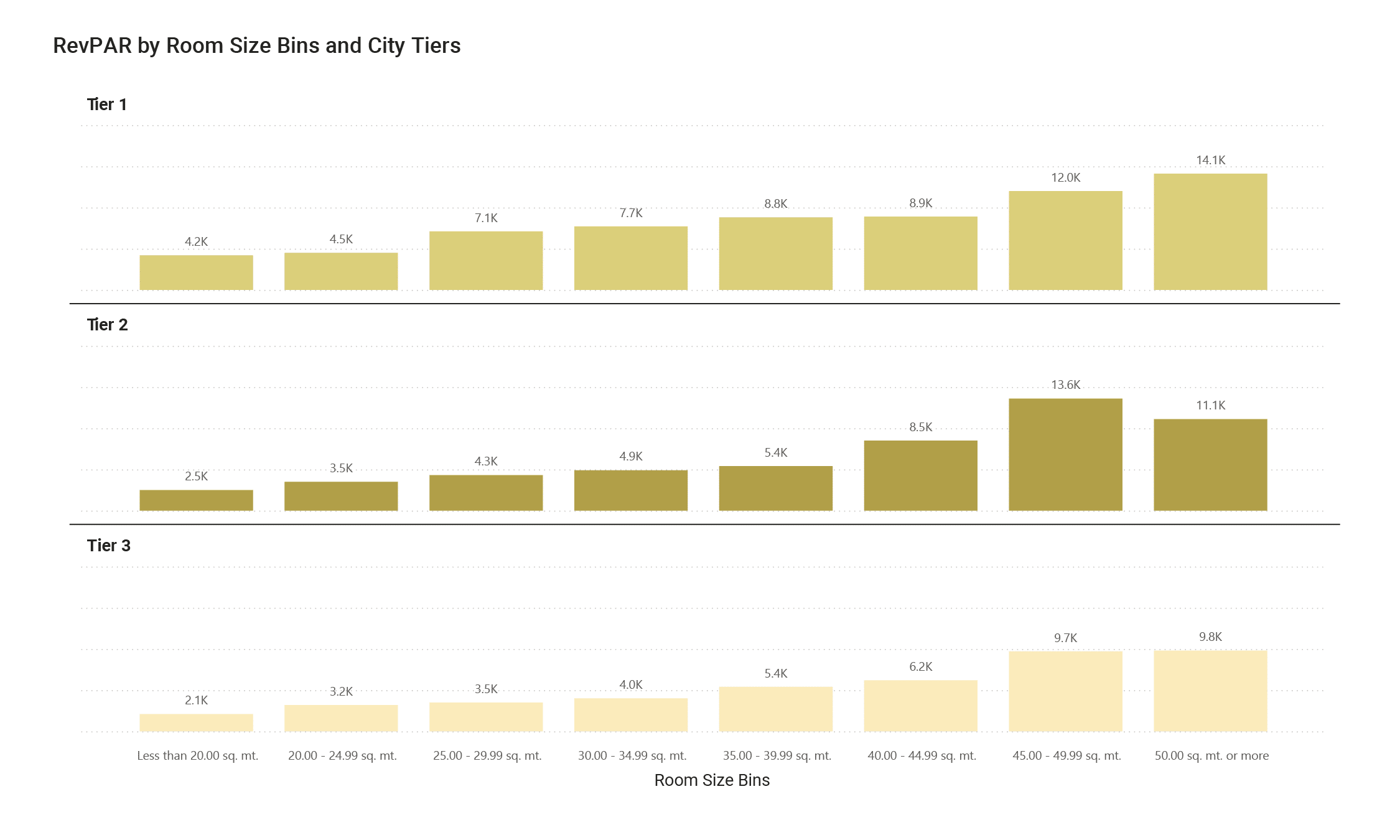

7. RevPAR by City Tiers and Room Size: With respect to the city tiers, in Tier 2 and Tier 3 markets, the 45 m² to 50 m² base room size bracket performs at par with — and in some cases outperforms — hotels with base room sizes of 50 m² or higher.

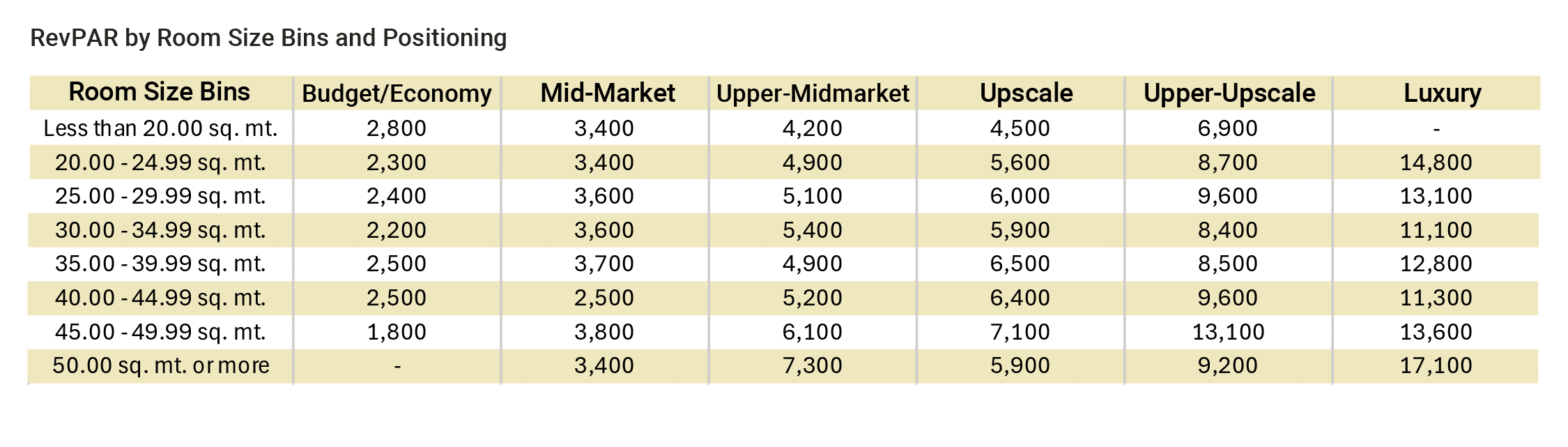

8. RevPAR by Positioning and Room Size: On the other hand, when reviewing the data with respect to positioning, several clear patterns emerge including:

a) Budget and Midmarket: There is no evident benefit in over-building the product beyond basic specifications. A consistent pattern is observed whereby RevPAR remains capped at a certain level irrespective of room size. For the budget segment, a base room size of 20–22 m² is sufficient, while for the midmarket segment, 24–26 m² is adequate to ensure healthy yield.

b) Upper Midmarket: Although performance improves to an extent with an increase in room size, the benefits are not commensurate with the additional development cost. For this segment, the ideal base room size falls within 28–30 m². Increasing this to 50 m² — approximately a 70% increase in area — translates into only a 40–45% improvement in RevPAR.

c) Upscale and Upper Upscale: The performance sweet spot lies between 30–40 m². While a few outliers exist within the sample set, base room sizes of 32–34 m² for upscale hotels and 36–38 m² for upper upscale hotels appear sufficient to maximise performance.

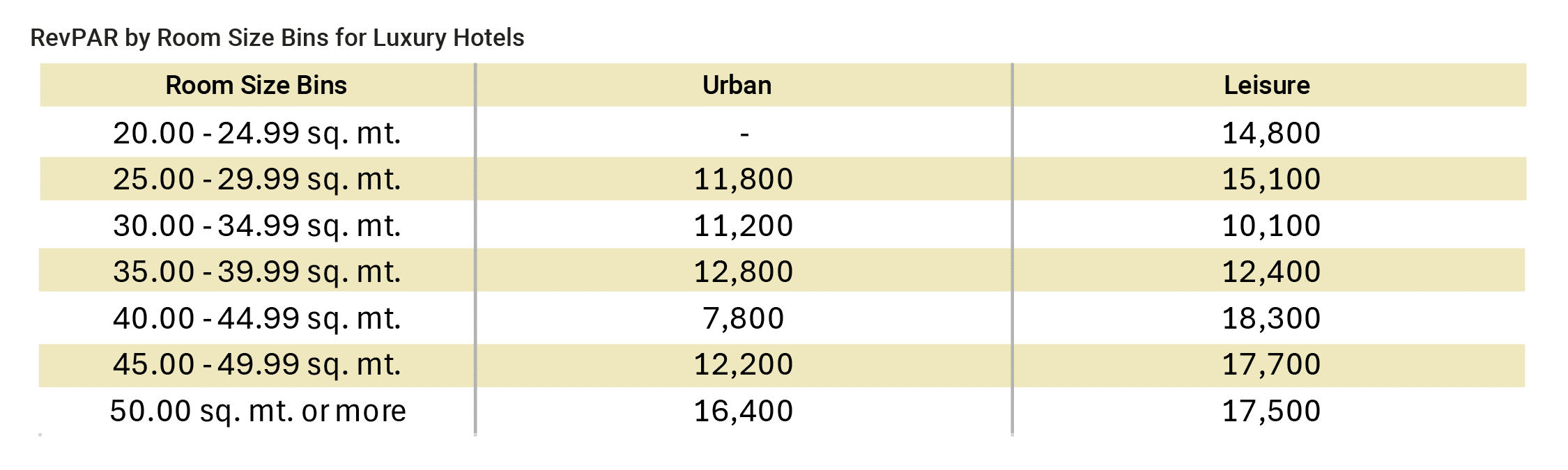

d) Luxury: These hotels show a steady trend with the highest RevPAR properties having a base room sizes of 50 m² or higher. However, within the 25–50 m² range, RevPAR remains relatively similar, indicating that the 45–48 m² mark is the sweet spot for the segment. Even when further analysing the 50 m² or higher category by type of location, leisure hotels do not display a discernible performance difference compared to the 45–50 m² range. In the case of urban hotels, the observed delta is attributable primarily to marquee and legacy assets.

The analyses suggest a limited correlation between room size and RevPAR, with diminishing utility beyond the ‘sweet spot’. Building larger rooms does not yield commensurate benefits in terms of returns. Expectedly, location remains a primary determinant of a hospitality venture’s success. In addition, factors such as nature of the location (urban vs leisure), brand strength, legacy, distribution reach, character and overall product–market fit play a greater role in driving performance than incremental changes in room size. Well-planned development which are aligned with the market expectations and the ground reality remains critical to ensure healthy returns.

For more information, please contact Megha Tuli ([email protected]) and Mihir Chalishazar ([email protected])